Expertise

Support

Accuracy

Efficiency

CreditXpert

CreditXpert Wayfinder™ and CreditXpert What-If Simulator™ are currently available through United One’s Mortgage Credit Link Software. Used in conjunction with our mortgage credit reports and expedited dispute process, these tools will allow mortgage lenders to obtain a competitive advantage in the marketplace.

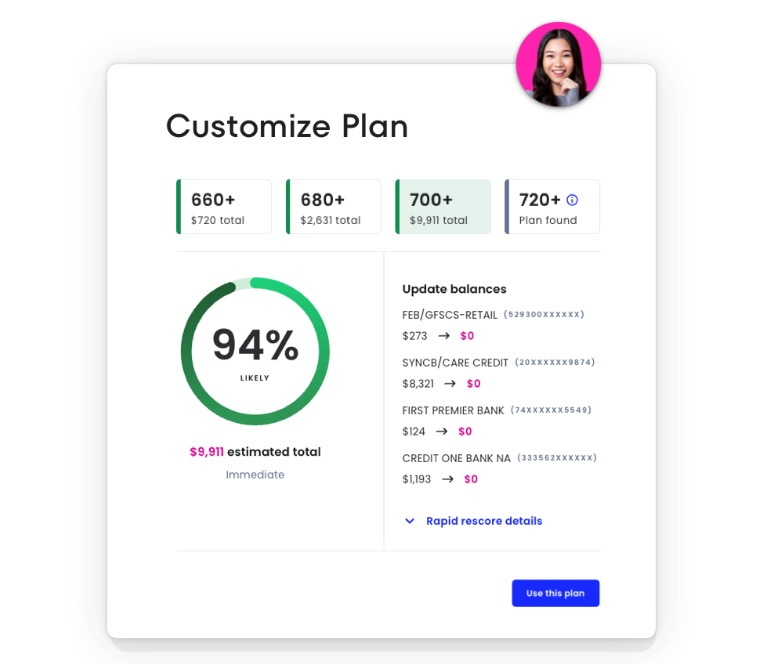

Through proprietary technology, CreditXpert analyzes the risk score from each of the three credit reporting agencies and provides a detailed look at a consumer’s credit report and the positive and negative factors that are influencing its risk score. The product suggests changes to the credit report that will have a positive impact on the score, based on the consumer’s available funds.

The CreditXpert What-If Simulator ™ allows you to simulate changes at the account level to determine the impact these changes to the credit report will have on the risk score.

CreditXpert Wayfinder™ allows you to find the fastest route to a target mid-score. With the click of a button, you’ll have an actionable plan within seconds.

After determining your course of action through the CreditXpert product line, United One’s expedited dispute process can be used to update the information reported to the three national credit reporting services. With the proper documentation, you will receive an updated credit score within three business days in most situations.

A live demonstration and more information on CreditXpert are available upon request.

A member of United One’s team would be pleased to speak with you about this or any of our risk management information services in more detail. Please contact our office at 800-WE-CLOSE x2830, or send an e-mail to credit@unitedone.com.

The success of our company is tightly connected to the success of our customers and our employees. We excel at personal customer service, process innovation, and technology leadership to improve and accelerate our customers’ lending decisions.